We're In The Money?

By: Nancy Anderson, Ph.D.

October 10, 2019

As with most things in life, climate-conscious investors ought to place a premium on assurances that they will get what they're paying for. But, for such investors, comprehensive and trusted information sources are not systematically available. While such resources are not the only things lacking in the struggle for a climate-sane planet — the need for ambitious, comprehensive and enforceable public policies comes immediately to mind — making climate-smart financial decisions have not yet emerged as the new normal.

What's missing? According to Earth Institute sustainability scholar Steve Cohen, today, "The measurement of organizational and local sustainability is conducted and verified by a host of nonprofit organizations… The problem with all of these is structural: Nearly all of these organizations generate revenues by certifying the "sustainability" of other organizations. It's fine that sustainability measurement is a business, so is accounting, but what's missing is the independent audit" 1

What about other independent and accessible risk-assessment data relevant to the universe of climate-impacted stock market investing? The U.S. Securities And Exchange Commission (SEC) now requires some climate risk reporting for publicly traded companies when they file mandatory 10-K disclosure documents. 2 But that's just a narrow band of information for individual or institutional stock investors. What about bonds? What about banks? What about insurance companies, where "Today, over 100 globally significant financial institutions have divested from thermal coal, including 40% of the top 40 global banks and 20 globally significant insurers." 3 And, what about the black box of hedge fund investing?

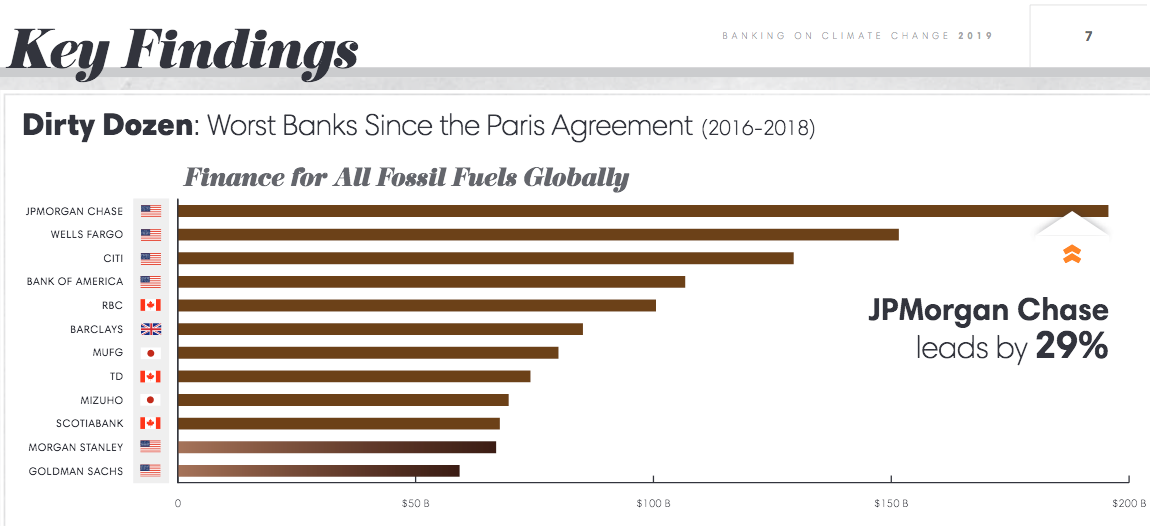

Today, sophisticated studies of climate investment and impact profiles of these sectors of the finance universe are starting to appear. For example, Banking on Climate Change: Fossil Fuel Report Card 2019, which "for the first time… adds up lending and underwriting from 33 global banks 4 to the fossil fuel industry as a whole" and finds that "fossil fuel financing is dominated by the big U.S. banks, with JP Morgan Chase as the world's top funder of fossil fuels by a wide margin." Similarly, the financial think tank Carbon Tracker makes use of "leading industry data bases to map both risk and opportunity for investors on the path to a low-carbon future." In 2019, Carbon Tracker posted a new investor tool 5, Climate Action100+, that aims to help its members "engage with power utilities to ensure they align their generation activities with the temperature goal in the Paris Agreement and manage the risks associated with a transition to a low carbon economy."

Just this month, the venerable World Resources Institute came out with a Green Targets Tool. This tool 6 drills down into the sustainability practices of the world's largest 50 private sector banks. WRI analysis found that "only 23 of them had a sustainable finance target. And such targets or commitments don't in themselves demonstrate an institution's concrete implementation and execution of sustainability in its concrete allocation of capital."

My shout outs to leading-edge finance climate and sustainability resources and reports are neither a comprehensive nor representative survey of climate finance disclosure today. But you get the idea. There is sophisticated analytic work being done and there's more mainstream media reporting than there was even 5 years ago, in top tier places like the Financial Times 7 and The New York Times 8 where coverage focuses on how far we are from a tipping point on decarbonizing investments and corporate conduct. This is important work. But where can those in need of reliable information, analysis and indexes or benchmarks go to routinely access news about the financial world as it impacts the persistence of old ways, or the emergence of new financial practices that can light the way toward decarbonization?

What we need now is a Carbon Finance News and Notes platform. Just think! a monthly report from an independent, credentialed and credible organization that aggregates information from myriad relevant finance sector, think-tank, scholarly, legal and breaking news sources. CFNN's challenge would be to find nimble ways to become a widely-read, go-to source for this universe of information and analysis. Its impact should be defined by how well it enables the expansion and application of climate financial literacy for investors and their advisors, climate policy makers and activists as well as government agencies who set the rules for mandatory carbon disclosure and financial risks.

The CFNN might take the form of a regularly updated database or it could incorporate narrative. The Sabin Center for Climate Law at Columbia Law School provides two searchable online databases of climate change litigation, one for U.S. climate change litigation and one for non-U.S. cases. 9 It exemplifies one possible approach to a CFNN, but it's not the only feasible model. What's crucial is that the CFNN be created, maintained and regularly updated by a highly credible and independent source able to attract a wide readership. It should not be hidden behind a paywall. Instead, it should develop a social media presence to advance the mission of getting out the message.

What would make a useful and well used CFNN? I invite Sallan's readers to weigh in on the CFNN proposal, whose intended purpose is to provide private and public finance-focused useful knowledge for greener cities — and for unloading the climate gun pressed against our global temples right now. Email your ideas and reactions. Sallan will post them.

Bibliography

- Cohen, Steve. “Defining and Measuring Sustainability.” State of the Planet, Earth Institute Columbia University, 7 October 2019, blogs.ei.columbia.edu/2019/10/07/defining-measuring-sustainability/. ↩

- The SEC Sustainability Disclosure Search tool scours the text of SEC annual filings (10-Ks, 20-Fs and 40-Fs) and automatically identifies relevant disclosures specifically addressing climate change risks, carbon asset risks or other issues. Link to The SEC Sustainability Disclosure Search tool ↩

- Source: Buckly, Tim. IEEFA, 27 February 2019, Over 100 Global Financial Institutions Are Exiting Coal, With More to Come. Link to Institute for Energy Economics and Financial Analysis Report. ↩

- “Big Banks Stoke the Flames of the Climate Crisis, Source: Banking On Climate Change Fossil Fuel Finance Report Card 2019, BankTrack, March 20, 2019, https://www.banktrack.org ” ↩

- “Carbon Tracker to Measure World's Power Plant Emissions from Space with Support from Google.org.” Carbon Tracker Initiative, 8 May 2019, https://www.carbontracker.org/carbon-tracker-to-measure-worlds-power-plant-emissions-from-space-with-support-from-google-org/. Link to Carbon Tracker ↩

- “GREEN TARGETS: A Tool To Compare Private Sector Banks Sustainable Finance Commitments. World Resources Institute, 3 Oct. 2019 https://www.wri.org/finance/banks-sustainable-finance-commitments/. ” ↩

- Flood, Chris. “ Investors Struggle to Make US Companies Change Tack on Climate Change ” Financial Times, Financial Times, 6 Oct. 2019, https://www.ft.com/content/d0c4af5f-0004-3d0f-8238-e28be38a8327 ↩

- The New York Times. “Climate and Energy Experts Debate How to Respond to a Warming World.” The New York Times, 7 Oct. 2019, https://www.nytimes.com/2019/10/07/business/energy-environment/climate-energy-experts-debate.html ↩

- “See Climate Change Litigation Databases ” Sabin Center for Climate Change Law. Climate Change Litigation, climatecasechart.com ↩